They raise your automobile insurance coverage rates as a bush versus this enhanced danger. Statistics reveal that any insurance claim will certainly enhance the ordinary cost of auto insurance coverage from 3% to 32% over the following 3 to five years. To put it simply, see to it that the case is worth the hassle as well as sunken costs of cars and truck insurance coverage premiums in the future.

In some circumstances, this addition to your car insurance plan makes sure that your prices will not go up for a case if you're in a crash. Most common types of car insurance policy discount rates Even if you're a reasonably secure driver, you can still conserve also extra on your typical vehicle insurance coverage prices by making the most of discount rates used by car insurance firms.

This isn't just to reveal recognition, but additionally since military participants tend to posture much less danger than various other chauffeurs. Safe chauffeur discounts: Another way to decrease your ordinary vehicle insurance policy costs is by finishing an eligible security program every few years. By doing so, your insurer regards you a much more accountable driver, reducing your risk and costs in the process.

suvs vehicle money vehicle

suvs vehicle money vehicle

This indicates that if you maintain a B-average or much better, you'll obtain a small discount rate off your insurance costs. Ways to decrease your car insurance costs Vehicle drivers that check all the boxes for better automobile insurance coverage rates don't have to be pleased with a "sufficient" rate. A terrific driving record, good credit, as well as various other elements might give you reduced ordinary car insurance expenses, yet you can save also a lot more by adhering to a few suggestions. cheap insurance.

The smart Trick of How Much Does Car Insurance Cost By State? - Progressive That Nobody is Discussing

The average vehicle insurance costs each year is $611 for the minimum liability car insurance policy. The type of coverage you require, your driving record, as well as where you live will certainly be the greatest aspects in exactly how much you'll pay either over or below the ordinary cost of automobile insurance. Just how much should you pay for full insurance coverage vehicle insurance coverage? The typical cost in the united state

Relying on where you live, how well you drive, just how old you are, and a variety of other aspects, your price for full insurance coverage cars and truck insurance might be much less, or it might swell also higher. In some states, the typical cost is $2,400. Budget plan accordingly. What identifies just how much you pay for cars and truck insurance coverage? Along with where you live, your driving document, and also your kind of protection, automobile insurance coverage business utilize a couple of various other metrics to establish your car insurance policy prices.

At what age is vehicle insurance coverage most inexpensive? For both men and also females, automobile insurance coverage is usually at its most affordable when you are around the age of 60. At this age, you are considered to be much less vulnerable to risky driving. You are also most likely to drive less and are perceived to be more solvent.

That's what makes Jerry your biggest ally in the look for the very best vehicle insurance coverage prices - cheaper car insurance.

3 Of The Best And Worst Companies For Car Insurance Things To Know Before You Get This

Having the appropriate information in hand can make it simpler to obtain an accurate car insurance policy quote. cheaper cars. You'll intend to have: Your motorist's permit number Your automobile identification number (VIN) The physical address where your lorry will be saved You may additionally intend to do a little research study on the sorts of coverages available to you.

The typical annual cost of cars and truck insurance policy in the united state was $1,057 in 2018, according to the most up to date information readily available in a record from the National Organization of Insurance Coverage Commissioners. Understanding that statistic won't necessarily help you figure out exactly how much you will certainly be paying for your own protection.

business insurance cheap car insure insurance companies

business insurance cheap car insure insurance companies

To much better comprehend what you need to be spending for vehicle insurance coverage, it's ideal to find out about the means firms determine their rates. Keep reviewing for a review of the most typical components, as well as exactly how you can gain a few extra savings. Calculating Average Annual Cars And Truck Insurance Coverage Cost There are a great deal of aspects that go into identifying your automobile insurance policy price.

Here are some key variables that influence the average price of cars and truck insurance coverage in America.: Men are usually considered as riskier motorists than women. The stats reveal that females have fewer DUI cases than men, along with fewer crashes. prices. When females do get in a crash, it's statistically less most likely to be a serious crash.

Some Of Car Insurance Coverage Calculator - Geico

The data bear that out, with wedded people getting in less mishaps. Consequently, married individuals save money on their prices. Something much less noticeable goes to play right here, too; if your state mandates particular criteria for vehicle insurance that are more stringent than others, you're most likely to pay even more money. Michigan, as an example, needs residents to have limitless lifetime individual injury protection (PIP) for accident-related clinical expenditures as a component of their car insurance policy.

The 2nd least pricey state was Maine, followed by Iowa, South Dakota, and also Idaho.: If you are utilizing your car as an actual taxi or driving for a rideshare service, you will need to pay even more for insurance coverage, as well as you might require to pay for a different kind of insurance coverage entirely - cars.

: The size of your commute, how usually you utilize your vehicle, why you utilize your auto, and where you park all impact your costs. If you have a long commute, you are subjected to the dangers of the roadway for longer - cheap auto insurance. If you drive regularly, you're revealed to the dangers of the roadway a lot more frequently.

insure insurance cheap accident

Installing monitoring software on your lorry could help decrease your premiums when you have a less-than-perfect history.: That very sleek sports cars and truck you've constantly desired? It's not simply going to cost you the sticker label rate: driving an important auto makes you riskier to guarantee.

Car Insurance Cost - Marketwatch Fundamentals Explained

Insurance coverage premiums likewise account for the total security of an automobile as well as the ordinary cost of repairs. If you're looking to conserve on insurance policy, purchase a minivan, a reasonable sedan, or an SUV.

Remember that you obtain what you pay forif you're in an accident, you'll most likely be pleased you really did not pick this as an area to stretch a dollar and also save money on. On the other hand, if you never require to make a claim, you'll have swiped the extra cost savings without effect.

prices cheaper affordable car insurance risks

prices cheaper affordable car insurance risks

You already recognize that not all coverage levels are created equivalent, however until you go out as well as see what's offered, you will never know whether or not you're getting the ideal offer for the quantity of insurance coverage you want.: Are you a straight-A student? These Click to find out more are just a few of the high qualities that could make you qualified for a discount on your insurance coverage premium.

It might not offer sufficient protection if you're in a crash or your automobile is harmed by another covered event. Curious regarding how the typical price for minimal protection piles up versus the cost of complete insurance coverage?

The Ultimate Guide To Car Insurance Prices - State Farm®

The only method to understand specifically how much you'll pay is to go shopping around and also obtain quotes from insurance firms. Among the aspects insurance providers utilize to identify rates is location. Individuals that live in areas with higher theft prices, mishaps, as well as all-natural calamities generally pay more for insurance policy. And also because insurance policy regulations as well as minimal insurance coverage demands differ from state to state, states with higher minimum requirements commonly have greater ordinary insurance policy prices.

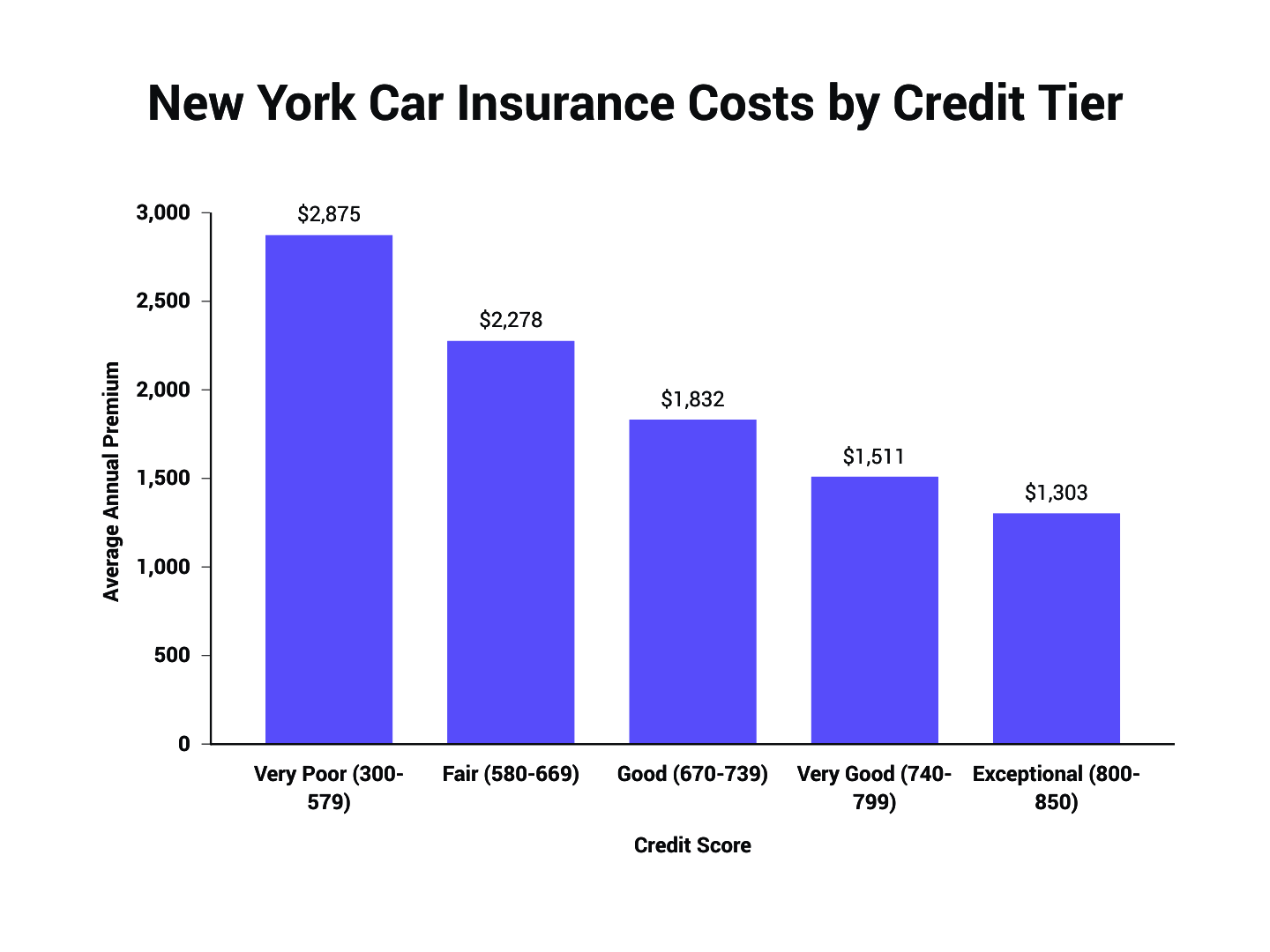

Most but not all states permit insurance provider to make use of credit history when setting rates. As a whole, candidates with lower scores are most likely to sue, so they typically pay more for insurance policy than vehicle drivers with higher credit history ratings. If your driving document includes accidents, speeding tickets, DUIs, or various other offenses, anticipate to pay a greater premium. cheaper car insurance.

Autos with greater cost typically cost more to guarantee. Motorists under the age of 25 pay greater prices as a result of their lack of experience and enhanced crash danger. Guy under the age of 25 are commonly priced quote greater rates than ladies of the exact same age. However the space diminishes as they age, as well as females may pay slightly a lot more as they grow older.

Due to the fact that insurance coverage firms have a tendency to pay more cases in high-risk locations, rates are normally higher. Getting married normally results in reduced insurance costs. Getting appropriate coverage might not be inexpensive, but there are means to obtain a discount rate on your vehicle insurance coverage. Below are 5 common discounts you might get approved for.

Here Is The Average Cost For Auto Insurance In 2021, And How ... Can Be Fun For Anyone

If you have your home rather than renting it, some insurance providers will offer you a discount rate on your auto insurance costs, even if your residence is guaranteed with another firm. Various Other than New Hampshire and also Virginia, every state in the country requires vehicle drivers to maintain a minimum quantity of responsibility coverage to drive legitimately.

dui trucks cheap car auto

It may be alluring to stick to the minimal limits your state needs to reduce your costs, yet you could be placing on your own at threat. State minimums are infamously low and also might leave you without adequate defense if you're in a significant accident. The majority of specialists advise preserving sufficient coverage to protect your properties. liability.

Maintaining the minimum amount of insurance coverage your state calls for will certainly allow you to drive legally, and also it'll set you back much less than full protection. However it may not offer adequate security if you're in a crash or your car is damaged by an additional covered case. Curious concerning how the ordinary price for minimum insurance coverage stacks up against the price of complete protection? According to Insurify (cheap auto insurance).

The only means to know exactly how much you'll pay is to go shopping about and obtain quotes from insurance companies. And given that insurance coverage legislations as well as minimal coverage demands vary from state to state, states with higher minimum requirements typically have greater average insurance prices.

Everything about Facts + Statistics: Auto Insurance - Iii

The majority of however not all states allow insurance policy firms to utilize credit rating when establishing rates. In basic, candidates with lower scores are most likely to file a claim, so they commonly pay a lot more for insurance than motorists with higher credit rating. If your driving document consists of crashes, speeding up tickets, Drunk drivings, or various other offenses, expect to pay a greater premium.

Cars with higher cost generally set you back more to insure. Motorists under the age of 25 pay greater rates because of their lack of experience and also boosted accident danger. Men under the age of 25 are normally estimated higher prices than ladies of the very same age. credit. However the void shrinks as they age, as well as females may pay a little much more as they get older.

Due to the fact that insurer have a tendency to pay more claims in high-risk locations, prices are generally higher. Connecting the knot generally results in lower insurance costs. Obtaining adequate insurance coverage might not be economical, however there are methods to obtain a discount on your automobile insurance policy. Right here are five common discounts you might receive - cheap insurance.

If you own your residence rather of leasing it, some insurers will provide you a discount rate on your automobile insurance premium, also if your house is insured through an additional company. Besides New Hampshire and Virginia, every state in the nation calls for motorists to keep a minimum quantity of responsibility coverage to drive lawfully (car insured).

How Much Is Car Insurance? - Nationwide Can Be Fun For Everyone

It may be tempting to stick with the minimum restrictions your state calls for to save money on your premium, however you can be putting yourself in danger. State minimums are notoriously low and might leave you without adequate security if you're in a severe crash. Many experts recommend maintaining enough insurance coverage to secure your possessions (auto insurance).